Tuesday, April 7, 2009

6 BEST WAYS TO INVEST IN GOLD

Let's assume, for the sake of brevity, that you've already decided to invest in gold, but are unsure how to go about it. This way, we can skip the large list of compelling reasons to do so and get on with the "how to."

There are six ways to invest in gold, and each of them has varying degrees of risk versus upside potential. The six ways are:

1. Buy gold bullion

2. Buy gold exchange traded funds

3. Buying gold derivatives

4. Buy jewellery

5. Buy shares in a top-producing gold mining company

6. Buy shares in a junior company exploring for gold

1. Bullion

Owning gold bullion is both simple and complicated. It is simple because you can go to any bullion exchange in any major city and purchase as much as you can carry. Bullion can be purchased in units as small as one tenth of an ounce (coins, bars) or as big as a 400 oz. gold bar (currently selling for $269,040.00 and weighing a hefty 800 pounds!)

Your investment gains will be determined by rises and falls in the spot market price plus whatever fees the exchange charges where you purchased your bullion.

In some cases, you can purchase the gold and pay an extra fee for storage of the gold at secure premises. Therein lies the complicated part of owning physical gold.

If you accumulate gold at your home, you increase the risk of losing your entire investment to theft every time you add to your hoard. But if you pay storage fees, the return on your investment is negatively affected.

Incidentally, if you store your gold at the exchange, you receive a certificate confirming your ownership of the amount of gold you've purchased. This is in fact exactly how the first paper currency came about.

2. Gold-Backed Securities, Exchange Traded Funds

The second way to invest in gold is sort of like owning bullion, but you don't need to concern yourself with the storage and security of the actual gold--that is handled by the company that sponsors an Exchange Traded Fund (ETF).

ETFs are traded on all major exchanges around the world. The number of units you own in an ETF directly corresponds to an amount equal to the dollar value of each unit in gold, plus whatever management fees are involved.

3. Gold Derivatives

A gold "future" is a contract to either deliver or receive a certain quantity of gold on a certain date at a certain price. Futures are a form of "derivative" investment, and are attractive because of the leverage that can be realized because only a small percentage of the commitment is required to be on account at the time the contract is purchased or sold.

This leverage means that you can gain control of much greater quantities of gold than you could if you just bought physical gold or ETFs. But the downside exposure is equally great.

Futures prices are determined by the market's perception of what the carrying costs--including the interest cost of borrowing gold plus insurance and storage charges--ought to be at any given time. The futures price is usually higher than the spot price for gold.

Whereas futures are firm obligations to buy and sell gold, "options" are the right, but not the obligation, to buy ("call" option) or sell ("put" option). The cost of such an option depends on the current spot price of gold, the pre-agreed price (the "strike price"), interest rates, the anticipated volatility of the gold price and the period remaining until the agreed date.

The higher the strike price, the less expensive a call option and the more expensive a put option. Like futures contracts, buying gold options can give the holder substantial leverage. Where the strike price is not achieved, the option is not exercised and the holder's loss is limited to the premium initially paid for the option. Like shares, both futures and options can be traded through brokers.

4. Jewellery

The first use for gold besides as money was as jewellery. Today, there are few people in the civilized world who don't own and regularly wear some form of gold as personal adornment. In some cultures (India especially) it is a predominant form of wealth display and accumulation.

Though not typically purchased as an investment, gold in jewellery form can appreciate substantially over time--especially if it is designed by someone whose fame elevates the demand and thus the price for their work.

Well preserved antique gold jewellery can also command prices exponentially higher than its original value.

5. Gold Producer Shares

The top five gold producing companies in the world today are:

1. Barrick Gold Corp. (NYSE: ABX)

2. Newmont Mining Corp. (NYSE:NEM)

3. Anglo-Gold Ashanti Ltd (NYSE:AU)

4. Gold Fields Ltd (LSE:GOF)

5. Harmony Gold Mining Ltd (NYSE:HMY).

Purchasing shares in these companies provides leverage to the upside if the gold price rises, as these companies' stock prices can rise much higher, when gold is gaining, than gold itself rises. The downside to investing in large producing companies like this is they can also fall farther than gold in bear markets.

Another risk of investing in large producing companies is the sudden dilution or devaluation that will occur if one company tries to take over another. A classic example of this is the case where ex-Goldcorp CEO Rob McEwen publicly opposed the merger of the company he built with Glamis Gold. The $8.6 billion all-stock deal was the second largest gold deal ever, after Barrick's acquisition of Placer Dome.

He was extremely disappointed, as the largest non-institutional shareholder of Goldcorp, when the share price dropped by 27% on the announcement of the acquisition, and is currently still 20% below Goldcorp's price before the announcement.

6. Junior Exploration Shares

Widely considered to have the greatest potential leverage to the price of gold, the vibrant junior exploration sector is in the sixth year of a spending boom, as investment banks and senior producing companies acknowledge the role of juniors in discovering the deposits that become tomorrow's mines.

Over half of the world's junior exploration companies are organized, financed and listed in Canada on the Toronto Venture Exchange, one of the world's top performing exchanges in the last five years.

Junior mining companies are typically very small and relatively thinly traded compared to the producing seniors, but here is where the real money is made.

A case in point: Aurelian Resources Corp. This company's stock went from CA$0.61 on March 28, 2006, to a breathtaking $40 in November of the same year! Anyone who invested $10,000 in Aurelian in that time frame would have taken home a whopping $655,737.70, for a gain of 6,457% in just eight months.

Aurelian Resources was just another junior mining company in 2003, with a portfolio of properties in Ecuador, of all places. Ecuador had never had a major discovery, and many institutional investors considered the country politically unstable. That didn't stop Dr. Keith Barron and his partner Patrick Anderson from staking 38 square kilometers.

Drilling began the same year, and decent results propelled the company to $2.25 by the end of the year. Nothing much happened after that until April 2006, when the company announced the astonishing drill intersection of 4.14 grams of gold per tonne over 237 metres, equivalent to a 52 story skyscraper. Well, the stock took off, and delirious investors rejoiced.

Now obviously this doesn't happen every day, but with an estimated 1,200 junior companies exploring for gold around the world today, another Aurelian can happen at any moment.

I recommend looking for junior mining companies with savvy management, a proven track record and a decent land package in a geopolitically safe country. You need to make sure you are properly positioned.

And that's where Gold World comes in. Gold World is committed to provide you with unique investment opportunities that most investors don't even know exist.

You see, we're not just students of the markets. Our goal is to provide you with clear profit opportunities during what may one day be called 'the greatest commodity bull market in history'.

US NATIONAL DEBT BY LUKE BURGESS

The 20 Biggest Holders of U.S. National Public Debt

By Luke BurgessTuesday, April 7th, 2009

The U.S. National Public Debt is now over $11.2 trillion. And it's climbing at a rate of $2.7 million per minute!By the time you are done reading this article, the U.S. National Public Debt will have climbed over $20 million. And Uncle Sam is running up this tab with ever-increasing speed.In the past five months alone, the U.S. government has increased National Public Debt by $1 trillion. It has been the fastest jump in U.S. history.It took the American government a full 191 years (from 1791 until 1982) to rack up its first trillion dollars in national debt. The second and third trillions got on the scoreboard much more quickly. . . each within just four years.By the time George W. Bush was inaugurated as President in 2001, the National Public Debt stood at $5.7 trillion. The Bush Administration increased Public Debt by almost $4.9 trillion. Under his authority, Bush increased National Public Debt faster than nearly all of his predecessors combined.

What is U.S. National Pubic Debt?

U.S. National Public Debt comprises Debt Held by the Public and Intragovernmental Holdings. The Debt Held by the Public is all federal debt held by individuals, corporations, state or local governments, foreign governments, and other entities outside the United States Government less Federal Financing Bank securities. Types of securities held by the public include Treasury Bills, Notes, Bonds, TIPS, United States Savings Bonds, and State and Local Government Series securities.Intragovernmental Holdings are Government Account Series securities held by Government trust funds, revolving funds, and special funds; and Federal Financing Bank securities. A small amount of marketable securities are held by government accounts.

But I'm not just picking on Bush and the Republicans. . .

National Debt stood at $10.6 trillion on the day Barrack Obama took office. But if his budget projections are accurate, President Obama's administration will run up nearly as much national debt in four years as Bush did in eight. In fact, during the eleven weeks since Obama took office, the National Public Debt has increased almost $600 billion.And the federal budget he unveiled in February projects even faster increases in the National Public Debt. It is estimated that Public Debt will rise to almost $13 trillion by the end of the fiscal year on September 30th.The hundreds of billions of dollars being spent as part of the federal bailout of the financial markets is a leading factor in the rapid increase in government debt.And as the U.S. government spends an unprecedented amount of money to fix the nation's economy, there is a need to raise the cash to pay for it. This can only be accomplished by raising taxes, which is an very unpopular option, or through borrowing whereby America sells U.S. Treasury securities of varying maturity.For investors, U.S. government bills, notes, and bonds are considered a safe financial product with AAA ratings from agencies such as Moody's, Standard & Poor's, and Fitch. These credit rating agencies assume a guaranteed rate of return based on the "full faith and credit of the United States." The federal government has been partially funding operations via Treasury debt securities for decades. This borrowing adds to the National Public Debt. Much of that debt is held by private sector, but about 40% is held by public entities, including parts of the government.Here are the 20 biggest holders of U.S. government debt. . .

Advertisement

Get Your Piece of the $850 billion Infrastructure Stimulus

Failing infrastructure could be the crisis that defines the U.S. as a country, with far reaching consequences that will dwarf both peak oil and climate change.

To help alleviate infrastructure problems like failing bridges and water mains, and to stimulate a failing economy, an $850 billion infrastructure stimulus is being passed that will send infrastructure stocks soaring. Government funding will literally be pouring off their balance sheets.

And you can ride the trend for all it's worth. This new report outlines all the details, including the companies you need to know about in order to profit. Start making government-backed infrastructure gains today! Click here to learn more.

20. Republic of Ireland — $50 BillionAs a country with just 4.2 million citizens, Ireland currently holds $50 billion in U.S. government debt. Between January 2008 and January 2009, Ireland increased its holding of American debt by 221%.19. Germany — $56 BillionGermany is a member of the United Nations (UN), North Atlantic Treaty Organization (NATO), Group of Eight (G8), and Organization for Economic Co-operation and Development (OECD). It is a major economic power with the world's third largest economy by nominal GDP and the fifth largest in purchasing power parity. Germany is the world's largest exporter and second largest importer of goods. The central European country controls $56 billion in U.S. Treasuries.18. Switzerland — $62 BillionThe neutral, landlocked, alpine country, which hosts many international organizations including the Red Cross and World Trade Organization (WTO), owns just over $62 billion in U.S. debt.17. Hong Kong — $72 BillionRenowned for its expansive skyline and natural setting, Hong Kong holds about $72 billion in U.S. government debt. Hong Kong is one of the world's leading financial capitals, a major business and cultural hub, and maintains a highly-developed capitalist economy.16. Taiwan — $73 BillionAs another advanced, high-income Southeast Asian economy, Taiwan owns about $73 billion in U.S. Treasuries. The country's technology industry plays a key role in the global economy, as Taiwanese companies manufacture a giant portion of the world's consumer electronics.15. Luxembourg — $87 BillionWith a population of less than 500,000, Luxembourg owns over $87 billion in American debt. The tiny country is a founding member of the European Union (EU), NATO, UN, Benelux, and the Western European Union, reflecting a political consensus in favor of economic, political, and military integration. 14. Depository Institutions — $107 BillionAccording to the Federal Reserve Board of Governors, depository institutions, such as commercial banks, savings banks, and credit unions, hold over $107 billion in government debt.13. Russia — $120 BillionRussia is the largest country in the world, covering more than an eighth of the Earth's land area. With 142 million people, it is the ninth largest by population. The transcontinental country currently holds about $120 billion in U.S. debt. This figure increased 240% between January 2008 and January 2009.12. United Kingdom — $124 BillionBritain was the world's first industrialized country and the world's foremost power during the 19th and early 20th centuries. Today, the United Kingdom currently holds $124 billion in U.S. debt securities and has the fifth largest economy in the world by nominal GDP.11. Insurance Companies — $126 BillionThe Federal Reserve Board of Governors lists insurance companies as holding $126 billion in Treasury securities. This group includes property-casualty and life insurance firms.10. Brazil — $134 BillionBrazil is the fifth largest country in the world by geographical area, occupying nearly half of South America, and the fifth most populous country. The South American economic giant holds $134 billion in U.S. debt.9. Caribbean Banking Centers — $177 BillionThe U.S. Treasury identifies the Bahamas, Bermuda, the Cayman Islands, the Netherlands Antilles, Panama, and the British Virgin Islands as holding $177 billion in American debt.8. Oil Exporters — $186 BillionIncluded in the group of oil exporters are Ecuador, Venezuela, Indonesia, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, Algeria, Gabon, Libya, and Nigeria. The group combines for a total of approximately $187 billion held in U.S. government debt.7. Other Investors — $413 BillionThis diverse group includes individuals, government-sponsored enterprises, brokers and dealers, bank personal trusts, estates, and both corporate and non-corporate businesses for a total of $413 billion held in U.S. national debt.6. Pension Funds — $456 BillionPension funds control large amounts of cash, which is reserved for personal retirements, and are therefore obligated to make relatively safe investments, such as U.S. Treasury securities. This group includes both private and local government pension funds, totaling over $456 billion.5. State and Local Governments — $523 BillionState and local governments hold over a half-trillion dollars in U.S. Treasuries. The level of investment has remained very stable over the past three years, moving within the range of $517 billion and $550 billion from 2006 to 2009.4. Japan — $635 BillionAs another major U.S. trade partner, the archipelago country of Japan holds a huge amount of America's debt with a stunning $635 billion. Japan has the world's second largest economy by nominal GDP and the third largest in purchasing power parity. 3. Mainland China — $740 BillionThe economy of Mainland China is the second largest in the world after that of the United States with a GDP of almost $8 trillion by purchasing power parity. China has been the fastest-growing major nation for the past quarter of a century with an average annual GDP growth rate above 10%. As one of the world's continuous civilizations, consisting of states and cultures dating back more than six millennia, China now controls approximately $740 billion in U.S. debt.2. Mutual Funds — $769 BillionMutual funds hold the second largest amount of American debt compared to any other group. Including money market funds, mutual funds, and closed-end funds, this group of investments manages approximately $769 billion of U.S. Treasury securities.1. The Federal Reserve and U.S. Intragovernmental Holdings — $4,806 BillionThis probably comes to you as no surprise. The largest holder of U.S. government debt is the privately-owned Federal Reserve. The Federal Reserve system of banks and other U.S. intragovernmental holdings accounts for a stunning $4.8 trillion in U.S. Treasury debt. And with recent announcements from the Fed, another potential $1 trillion may be added to its balance sheet.

All this debt has put the United States economy and the U.S. dollar in a perilous situation, especially with the global economic recession right now. Historically, currencies were backed by precious metals. But in the current scheme of fiat money, the U.S. government is free to print all the money it wants. Consequently, the government cannot technically go bankrupt as any debtor nation can just issue more money through a practice known as seigniorage.However, a gross imbalance between the amount of new money being brought into circulation and the amount of economic goods represented by an economy is an unstable situation that can lead to hyperinflation.Nevertheless, there is a silver lining to this ominous cloud of debt. That's because. . .The shear size of this debt guarantees economic conditions that will allow informed investors to reap massive profits.I've already taken up a lot of your time today. But if you're interested in learning the whole truth about the debt of the United States, and how to profit from it, please keep reading here.

Good Investing,

THE GREAT AMERICAN DEBT MACHINE BY LUKE BURGESS

By Luke Burgess Monday, April 6th, 2009

Michael Alton Davies was just born at Northwestern Memorial Hospital in downtown Chicago.He weighs 7 pounds and 10 ounces. He is only minutes old. And yet, he is already saddled with a humongous debt.Believe it or not, Michael was born into debt. . . and he owes almost $250,000!His birth did not require special, expensive care. And he didn't inherit any debt from his parents or other family members.No, there is actually nothing special at all about Michael's debt situation. He is not alone.You see, young Michael — and every other citizen of the United States — will be responsible for paying the tab on a growing $70 trillion debt.To pay back this debt at $1,000,000 per day would take 191,780 years! And that's just what we as Americans owe today!This debt has put the United States in an extremely perilous situation, especially right now with the global economic recession. Nevertheless, there's a bright, silver lining to this ominous cloud of debt. That's because...

The shear size of this debt guarantees economic conditions that will allow informed investors to reap massive profits.Let me explain. It's all part of. . .The Great American Debt MachineThe U.S. Government has mastered the magician's art of illusion.They've become experts in crafting a distortion of reality. Namely, the American government has found a way to cover up 85% of the nation's actual debt! Here's what I'm talking about. . .The Feds essentially keep two sets of books that make up America's debt portfolio.The first set of of books is the widely publicized "National Public Debt."

The National Public Debt is currently over $11 trillion and is climbing at a rate of almost $4 billion per day.This is the figure that's quoted in the evening news and on the famous U.S. National Debt Clock in Manhattan. In the past century, this debt has skyrocketed nearly 400,000%.But the National Public Debt doesn't even come close to telling half of the story.

The U.S. Government Is Another $60 Trillion in the Hole!You see, the U.S. government doesn't classify future financial responsibilities — such as social security, government-sponsored health care, and other contractual obligations — as "public debt." And it's with this simple act of reclassification that the Feds have been able to shield the American public from the truth about the country's actual debt position.Nevertheless, calculations suggest that such financial obligations will no doubt cost the American taxpayers roughly $60 trillion!This debt is no secret among Washington insiders, nor is the fact that the government is trying to hide it. In fact, David Walker, the former U.S. Comptroller General and the nation's top accountant between 1998 and 2008 said, "As the federal official who signs the audit report on the government's financial statements, it is apparent that our government's financial condition is far worse than advertised."Walker has also said, "Current federal financial reporting and budgeting provides policymakers and the public with an incomplete and even misleading picture."Add it all up, and the United States government is on the line for almost $70 trillion in total financial obligations, including public debt.And like I said, that's just what we owe today! Check this out. . .The U.S. Government Accountability Office released a new report a few weeks ago called "The Federal Government's Financial Health." In this report, the GAO reported an expected increase in National Public Debt of over 500% within the next several decades!Take a look at the U.S. GAO's projections. . . and remember this is the U.S. government's own estimates. . .

A similar move in the nation's actual debt — that's the National Public Debt plus all other fiscal responsibilities — would result in a total financial obligation of over $550 trillion!That's over $1.8 million that would be owed for every American citizen today!It's time to. . .Get Your Checkbook Out!America's $70 trillion debt works out to about $500,000 per working American and is literally enough money to start your own country. . . maybe two. Heck, you might even have enough cash left over to fund a war between the two.As a result of this massive financial obligation, every American child is born into debt owing nearly a quarter million dollars!The interest on that debt alone is going to cost almost twice as much as educating the child!Now, forget about trying to assign blame to the Democrats or Republicans because this whole mess really got started back in the 1970s, and both parties are guilty, guilty, guilty.Besides, we can't change the past, despite how much we'd like to, sometimes. However, we can use this information to protect our financial future, and even reap substantial investment returns. And here's how to do that while the U.S. government's accountants. . .Face the MusicAmerica has been drunk on borrowed money over the past several decades. And now it's starting to catch up with us like a bad hangover.The result of this massive construction of debt has been directly reflected in the currency markets.And this escalation of debt is exactly why the value of the U.S. dollar has fallen as much as 42% since 2001.As a result of the devaluation of the greenback, and continuation of rising debt, countries around the world are now starting to seriously consider ditching the U.S. dollar as the world's main reserve currency.In fact, the Chinese government just came out a few days ago and proposed replacing the U.S. dollar as the world's dominant reserve currency with a new "international reserve currency."

An actual shift in reserve currency power would send the value of the U.S. dollar spiraling down. . . quite likely crashing to all-time lows.This great devaluation of the U.S. dollar is generally negative for investment markets across the board. But as I mentioned just a second ago, an informed investor has a huge advantage over their competitors and can use this information to profit greatly. But more on that in just a second.The replacement of the dollar as the world's main reserve currency is not as alarmist or as far-fetched as it may sound.In fact, the U.S. Secretary of the Treasury Timothy Geithner responded to China's proposal by saying he was "quite open" to its suggestion to displace the U.S. dollar.Other economists have suggested that the Euro may take over the lead reserve currency position.Former Federal Reserve Chairman Alan Greenspan gave his opinion in September 2007, saying that it is "absolutely conceivable that the euro will replace the dollar as reserve currency, or will be traded as an equally important reserve currency."Either way, it seems imminent that the value of the U.S. dollar is headed further south as the U.S. government will be forced to print more money to pay off this debt.The good news is that it's not too late to protect your financial well-being from the falling dollar and return a significant profit at the same time. All you need to know is. . . The Best Way to Profit from the Devaluation of the U.S. DollarAfter several months of searching, I've found two of the best U.S. dollar short positions. And they work as simple as this. . .Every time the U.S. dollar goes down, these two investment positions go up.But here's what makes these two investment vehicles special. . .Both of these positions are leveraged, which means that every time the U.S. dollar goes down, the return on your investment increases by a multiple.Now, the mainstream financial media hates these investment vehicles, and you'll never hear about them on CNBC or BNN. That's because the financial media has corporate masters that rely on the strength of the U.S. dollar to expand business.They try to sweep the truth about the continuing decline of the U.S. dollar under the rug. But sooner or later they'll have to face the music. And everyone with assets denominated in U.S. dollars will be negatively affected to some extent.As I mentioned just a minute ago, the value of the U.S. dollar has already fallen quite significantly over the past several years.But the market gods are offering a second chance to take advantage of the falling U.S. dollar. That's because. . .Over the past several months, the U.S. dollar has had significant strength as governments, central banks, and large financial institutions have been acquiring the greenback as a hedge against their own, presumably less-stable currencies in the face of the global recession/depression.But everyday more and more people around the world are starting to recognize the once great U.S. dollar as what it has become. . . an IOU for nothing!Wait, scratch that. The U.S. dollar is an IOU for less than nothing. . . it's an IOU for DEBT!How to Protect Against and Profit from a Falling U.S. DollarThe U.S. government is limited in how much it can raise taxes. So it will be forced to create new money to pay off its $70 trillion financial obligation. This inflationary pressure virtually guarantees the continuing decline of the U.S. dollar. And now that the greenback has had some strength, there's never been a better time to go short on the U.S. dollar.I have recently added the two leveraged U.S. dollar short investment positions to my 2009 Secret Stock Files Investment Strategy Portfolio. And I want to share them with you today, so that you too can protect your future financial well-being and profit from the continuing decline of the U.S. dollar.If you're interested in learning more about these two investment vehicles, just keep reading.

Friday, March 13, 2009

MY SENIOR RESEARCH PAPER ON "INVESTING IN PRECIOUS METALS"

Investing in Precious Metals

Jeremy H

Purvis High School

Abstract

There are several advantages of investing in precious metals. Precious metals are considered safe havens because of the current economy. The current recession and deflation of the United States dollar increases the value of the precious metals market. A majority of the percentage of investor’s invest in precious metals because of the large profits that can be made. The outlook for precious metals in 2009 is projected to be very high. New profit records should be set in the year of 2009 for all metals.

Investing in precious metals is a good way to become financially well. It has many different advantages. With the current situation of our economy, many investors are turning to any form of precious metals they can get. Some forms to invest in vary from physical possession of these metals to stocks, jewelry, and so on. The possibility of benefiting from this market is endless.

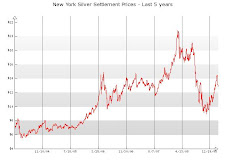

Bullion is the most common form of precious metals that people invest in. It varies from grams to even pounds in weight. The types of bullion offered are gold, silver, platinum, and finally palladium. Investors in bullion all have different goals and monetary investments to put into this growing market. Silver is one of the cheapest metals to invest in. Silver is also an excellent conductor used in electronic circuitry. However, with this lower cost it is also in high demand. Due to industrial demand, there is an ongoing decrease of above ground stocks. In the 1990's silver inventories decreased by 1.2 billion ounces. The United States government is now, for the first time ever, a buyer of silver. The United States had four billion ounces of silver in a reserve after World War II. As of November 2000, reserves were depleted because the last few ounces were delivered to the United States mint for production of silver eagle coins. Silver supplies are and are only produced as a by product. Most remaining mines produce mostly copper, gold, lead, and zinc. Gold is one of the most expensive metals that play a role in thousands of dollars worth of investing. Most large investors invest in gold. With gold investors risk more but the profit is greater. Gold is a very durable metal; it will not tarnish like silver. Some of the finer products made out of gold are rings, necklaces, earrings, bracelets, etc. Platinum is more expensive than gold and is truly known as high-octane gold. Platinum is known to be a multi purpose metal because of its unique physical properties. Many industries depend on platinum. Most of the jewelry today is made of platinum. Japan has long been a traditional source of platinum jewelry. Platinum is prized for its beauty and strength making it the most secure precious metal for setting stones. One of the newest metals is Palladium. Not many new investors know about this metal. Palladium is known as the metal for the twenty-first century. Like platinum, palladium serves as a pollution reduction in today’s automobiles. Palladium is a very good conductor like silver. Unlike silver, palladium does not tarnish. Palladium is one of the rarest metals in the world even when compared to gold and silver. In 2003 the world's mines produced 6.5 million ounces of palladium; the production of gold was 84.1 million and silver was at an amazing 595.6 million ounces (Northwest Territoral mint, n.d.)

There are many different ways to invest in precious metals for investors today. Some ways to invest are bullion, coins, and stocks. There are many different ways to make an precious metals portfolio. Three portfolios that people use for gold are the gold safety portfolio, gold profit portfolio, and finally gold balanced portfolio. All portfolios have various risks, but some risks are riskier than others. The gold safety portfolio is the method in which seventy percent of money is in physical bullion, which includes gold bars or coins. Out of gold production and gold exploration stocks, the gold production is the less risky. Gold is a form of stock and there are risks involved. The investor only needs to put ten percent in gold production. Finally the investor needs to put twenty percent in the Canadian dollar``. The reason why many investers are turing to a foregin currencey, is because of the falling United States dollar value. Witch makes the Euro, Japanese yen, British pound, Swedish krona and Swiss franc prime investment currencys. Next is the gold profit portfolio. This is the high risk, high reward portfolio. To achieve this portfolio only fifteen percent need to be in physical gold. The reason why physical gold is in such a low percentage is because physical gold is the safest form of investing. Next, the investor need's to put a majority of the portfolio in gold stocks, seventy percent to be exact. This is the high risk high reward investment. With this amount of percentage the investor can invest in gold exploration stocks. In which the company uses this money given threw stock, for gold exploration on their properties. Finally, the investor need's to put fifteen percent in the Canadian dollar, Euro, Japanese yen, British pound, Swedish krona and Swiss franc. The third and final portfolio is the gold balanced portfolio. This is the highly diversified and well rounded portfolio. Studies show that maintaining a balanced portfolio will produce the lowest risk reduction. Twenty-five perfect should be in physical gold. Next, forty-five percent should be in gold stocks. Finally, thirty percent should be invested in the Canadian dollar, Euro, Japanese yen, British pound, Swedish krona and Swiss franc. This type of portfolio will diversify investments and make it most beneficiary to the investor (Burgess, n.d.).

In a personal over the phone interview with Allen Snell, he said that his background for bullion is one year as managing NWT mint bullion department. When asked what percentage of a invester’s portfolio should be in bullion, he stated anywhere from ten to fifteen percent. Also he stated that it is never a bad time to start investing in bullion slowly and building up to greater amounts. Mr. Snell said that the best months to invest in bullion are January and December. Bullion prices are the lowest in the winter months. The best time to sell bullion is the summer months: August and September. Last year alone NWT mint sold over three hundred million dollars worth of bullion. NWT mint is one of the main suppliers in bullion. Mr. Snell figures that all the bullion sold throughout would be ten times three hundred million (January 2009).

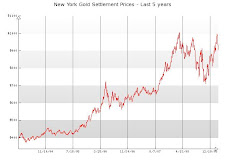

The investing markets are yielding to the fact that the global economy will remain weak in most of 2009. Under normal conditions safe haven investments would include land and real estate. With the falling housing, markets investors are staying away from all real estate. Precious metals are not considered a liability right now and are considered the best safe haven. Experts say because of the state of our economy, that it will drive precious metals prices up. In March of 2008, gold prices hit a record high of $1,033 dollars an ounce. This was followed by a normal eighteen percent correction, which pushed gold prices back down to $850 dollars an ounce. Gold prices rebounded and closed in on $1,000 dollars an ounce in mid-July. At the same time, the effects of the slowing housing market and credit markets were beginning to effect all investing. As a result, main gold positions were sold to cover losses from investments in other markets. Due to forced selling, this pushed the prices down over the next several months. During the later part of 2008, the United States dollar enjoyed a twenty percent increase as the price of gold was held down. Despite the lowering value of the dollar, it is still one of the world’s most important reserve currency. Foreign governments, institutions, and banks began to buy the United States dollar. This made the gold price to go to a year low of $683 dollars an ounce in October. Even though, gold had three twenty percent corrections and serious deflation in the market, gold came out with a positive 5.4% gain for the year. With this gain it out performed major index and commodity in the world. Some examples are Dow Jones at -34%, NASDAQ -41 %, S&P 500 -39%, and Oil -55%. The outlook for 2009 is expected to be an increase in prices. Due to Global economic turmoil and deflation in our dollar, it will continue to influence gold prices in the near term. Experts expect gold prices to break new records during 2009. It is expected to reach as high as $1,300 dollars or higher. The high would be a dramatic increase in price and profitability from years past. Precious metals are also expected to have as many as three or four selling points in 2009 (Burgess, 2009).

Many investors are turning away from the real estate market and turning to the precious metals market. Our recession makes bullion a good market to invest in and make a large profit in just a few years. The declining United States economy not only affects the bullion market, it also affects anything that uses precious metals. Jewelry, electronics, automotive and so many more areas are being affected.

Burgess, L. (n.d.) Investing in Gold. Retrieved February 18, 2009, from

http://goldworld.com

Burgess, L. (2009, January 5). Gold's 2009 outlook. Retrieved February 18, 2009, from http://goldworld.com

Northwest Territorial Mint - Custom Minting, Bullion Sales, Online Store. (n.d.). Retrieved February 18, 2009, from

http://nwtmint.com

Thursday, March 5, 2009

would set this country straight

What we need is first off to not even make this stimulus package. I mean our national debt will be over 60 trillion dollars for those who do not understand this that means that it would take YOU spending 1,000,000 dollar PER DAY it would take you 160,000 YEARS not days to meet our national debt!!!! I mean come on you don't get out of debt by spending more! Just give it time trust me your taxes will increase and inflation will take place! I'm 18 and to be honest i don't wont to pay outstanding taxes for the rest of my life! I work aready and taxes kill me! Try earning mininum wage and not haveing that much time because your always at the school. It suck's big time. Then my future kids and there kids will be paying for this. I'm HIGHLY against this Bailout! We needed to jus let it ride so to say because as my economics teacher says decomercy will always correct its self.