The Great American Debt Machine

By Luke Burgess Monday, April 6th, 2009

Michael Alton Davies was just born at Northwestern Memorial Hospital in downtown Chicago.He weighs 7 pounds and 10 ounces. He is only minutes old. And yet, he is already saddled with a humongous debt.Believe it or not, Michael was born into debt. . . and he owes almost $250,000!His birth did not require special, expensive care. And he didn't inherit any debt from his parents or other family members.No, there is actually nothing special at all about Michael's debt situation. He is not alone.You see, young Michael — and every other citizen of the United States — will be responsible for paying the tab on a growing $70 trillion debt.To pay back this debt at $1,000,000 per day would take 191,780 years! And that's just what we as Americans owe today!This debt has put the United States in an extremely perilous situation, especially right now with the global economic recession. Nevertheless, there's a bright, silver lining to this ominous cloud of debt. That's because...

The shear size of this debt guarantees economic conditions that will allow informed investors to reap massive profits.Let me explain. It's all part of. . .The Great American Debt MachineThe U.S. Government has mastered the magician's art of illusion.They've become experts in crafting a distortion of reality. Namely, the American government has found a way to cover up 85% of the nation's actual debt! Here's what I'm talking about. . .The Feds essentially keep two sets of books that make up America's debt portfolio.The first set of of books is the widely publicized "National Public Debt."

The National Public Debt is currently over $11 trillion and is climbing at a rate of almost $4 billion per day.This is the figure that's quoted in the evening news and on the famous U.S. National Debt Clock in Manhattan. In the past century, this debt has skyrocketed nearly 400,000%.But the National Public Debt doesn't even come close to telling half of the story.

The U.S. Government Is Another $60 Trillion in the Hole!You see, the U.S. government doesn't classify future financial responsibilities — such as social security, government-sponsored health care, and other contractual obligations — as "public debt." And it's with this simple act of reclassification that the Feds have been able to shield the American public from the truth about the country's actual debt position.Nevertheless, calculations suggest that such financial obligations will no doubt cost the American taxpayers roughly $60 trillion!This debt is no secret among Washington insiders, nor is the fact that the government is trying to hide it. In fact, David Walker, the former U.S. Comptroller General and the nation's top accountant between 1998 and 2008 said, "As the federal official who signs the audit report on the government's financial statements, it is apparent that our government's financial condition is far worse than advertised."Walker has also said, "Current federal financial reporting and budgeting provides policymakers and the public with an incomplete and even misleading picture."Add it all up, and the United States government is on the line for almost $70 trillion in total financial obligations, including public debt.And like I said, that's just what we owe today! Check this out. . .The U.S. Government Accountability Office released a new report a few weeks ago called "The Federal Government's Financial Health." In this report, the GAO reported an expected increase in National Public Debt of over 500% within the next several decades!Take a look at the U.S. GAO's projections. . . and remember this is the U.S. government's own estimates. . .

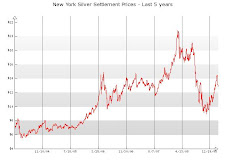

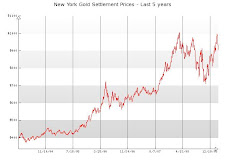

A similar move in the nation's actual debt — that's the National Public Debt plus all other fiscal responsibilities — would result in a total financial obligation of over $550 trillion!That's over $1.8 million that would be owed for every American citizen today!It's time to. . .Get Your Checkbook Out!America's $70 trillion debt works out to about $500,000 per working American and is literally enough money to start your own country. . . maybe two. Heck, you might even have enough cash left over to fund a war between the two.As a result of this massive financial obligation, every American child is born into debt owing nearly a quarter million dollars!The interest on that debt alone is going to cost almost twice as much as educating the child!Now, forget about trying to assign blame to the Democrats or Republicans because this whole mess really got started back in the 1970s, and both parties are guilty, guilty, guilty.Besides, we can't change the past, despite how much we'd like to, sometimes. However, we can use this information to protect our financial future, and even reap substantial investment returns. And here's how to do that while the U.S. government's accountants. . .Face the MusicAmerica has been drunk on borrowed money over the past several decades. And now it's starting to catch up with us like a bad hangover.The result of this massive construction of debt has been directly reflected in the currency markets.And this escalation of debt is exactly why the value of the U.S. dollar has fallen as much as 42% since 2001.As a result of the devaluation of the greenback, and continuation of rising debt, countries around the world are now starting to seriously consider ditching the U.S. dollar as the world's main reserve currency.In fact, the Chinese government just came out a few days ago and proposed replacing the U.S. dollar as the world's dominant reserve currency with a new "international reserve currency."

An actual shift in reserve currency power would send the value of the U.S. dollar spiraling down. . . quite likely crashing to all-time lows.This great devaluation of the U.S. dollar is generally negative for investment markets across the board. But as I mentioned just a second ago, an informed investor has a huge advantage over their competitors and can use this information to profit greatly. But more on that in just a second.The replacement of the dollar as the world's main reserve currency is not as alarmist or as far-fetched as it may sound.In fact, the U.S. Secretary of the Treasury Timothy Geithner responded to China's proposal by saying he was "quite open" to its suggestion to displace the U.S. dollar.Other economists have suggested that the Euro may take over the lead reserve currency position.Former Federal Reserve Chairman Alan Greenspan gave his opinion in September 2007, saying that it is "absolutely conceivable that the euro will replace the dollar as reserve currency, or will be traded as an equally important reserve currency."Either way, it seems imminent that the value of the U.S. dollar is headed further south as the U.S. government will be forced to print more money to pay off this debt.The good news is that it's not too late to protect your financial well-being from the falling dollar and return a significant profit at the same time. All you need to know is. . . The Best Way to Profit from the Devaluation of the U.S. DollarAfter several months of searching, I've found two of the best U.S. dollar short positions. And they work as simple as this. . .Every time the U.S. dollar goes down, these two investment positions go up.But here's what makes these two investment vehicles special. . .Both of these positions are leveraged, which means that every time the U.S. dollar goes down, the return on your investment increases by a multiple.Now, the mainstream financial media hates these investment vehicles, and you'll never hear about them on CNBC or BNN. That's because the financial media has corporate masters that rely on the strength of the U.S. dollar to expand business.They try to sweep the truth about the continuing decline of the U.S. dollar under the rug. But sooner or later they'll have to face the music. And everyone with assets denominated in U.S. dollars will be negatively affected to some extent.As I mentioned just a minute ago, the value of the U.S. dollar has already fallen quite significantly over the past several years.But the market gods are offering a second chance to take advantage of the falling U.S. dollar. That's because. . .Over the past several months, the U.S. dollar has had significant strength as governments, central banks, and large financial institutions have been acquiring the greenback as a hedge against their own, presumably less-stable currencies in the face of the global recession/depression.But everyday more and more people around the world are starting to recognize the once great U.S. dollar as what it has become. . . an IOU for nothing!Wait, scratch that. The U.S. dollar is an IOU for less than nothing. . . it's an IOU for DEBT!How to Protect Against and Profit from a Falling U.S. DollarThe U.S. government is limited in how much it can raise taxes. So it will be forced to create new money to pay off its $70 trillion financial obligation. This inflationary pressure virtually guarantees the continuing decline of the U.S. dollar. And now that the greenback has had some strength, there's never been a better time to go short on the U.S. dollar.I have recently added the two leveraged U.S. dollar short investment positions to my 2009 Secret Stock Files Investment Strategy Portfolio. And I want to share them with you today, so that you too can protect your future financial well-being and profit from the continuing decline of the U.S. dollar.If you're interested in learning more about these two investment vehicles, just keep reading.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment