Investing in Precious Metals

Jeremy H

Purvis High School

Abstract

There are several advantages of investing in precious metals. Precious metals are considered safe havens because of the current economy. The current recession and deflation of the United States dollar increases the value of the precious metals market. A majority of the percentage of investor’s invest in precious metals because of the large profits that can be made. The outlook for precious metals in 2009 is projected to be very high. New profit records should be set in the year of 2009 for all metals.

Investing in Precious Metals

Investing in precious metals is a good way to become financially well. It has many different advantages. With the current situation of our economy, many investors are turning to any form of precious metals they can get. Some forms to invest in vary from physical possession of these metals to stocks, jewelry, and so on. The possibility of benefiting from this market is endless.

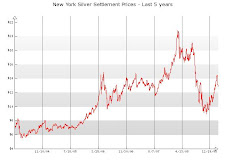

Bullion is the most common form of precious metals that people invest in. It varies from grams to even pounds in weight. The types of bullion offered are gold, silver, platinum, and finally palladium. Investors in bullion all have different goals and monetary investments to put into this growing market. Silver is one of the cheapest metals to invest in. Silver is also an excellent conductor used in electronic circuitry. However, with this lower cost it is also in high demand. Due to industrial demand, there is an ongoing decrease of above ground stocks. In the 1990's silver inventories decreased by 1.2 billion ounces. The United States government is now, for the first time ever, a buyer of silver. The United States had four billion ounces of silver in a reserve after World War II. As of November 2000, reserves were depleted because the last few ounces were delivered to the United States mint for production of silver eagle coins. Silver supplies are and are only produced as a by product. Most remaining mines produce mostly copper, gold, lead, and zinc. Gold is one of the most expensive metals that play a role in thousands of dollars worth of investing. Most large investors invest in gold. With gold investors risk more but the profit is greater. Gold is a very durable metal; it will not tarnish like silver. Some of the finer products made out of gold are rings, necklaces, earrings, bracelets, etc. Platinum is more expensive than gold and is truly known as high-octane gold. Platinum is known to be a multi purpose metal because of its unique physical properties. Many industries depend on platinum. Most of the jewelry today is made of platinum. Japan has long been a traditional source of platinum jewelry. Platinum is prized for its beauty and strength making it the most secure precious metal for setting stones. One of the newest metals is Palladium. Not many new investors know about this metal. Palladium is known as the metal for the twenty-first century. Like platinum, palladium serves as a pollution reduction in today’s automobiles. Palladium is a very good conductor like silver. Unlike silver, palladium does not tarnish. Palladium is one of the rarest metals in the world even when compared to gold and silver. In 2003 the world's mines produced 6.5 million ounces of palladium; the production of gold was 84.1 million and silver was at an amazing 595.6 million ounces (Northwest Territoral mint, n.d.)

There are many different ways to invest in precious metals for investors today. Some ways to invest are bullion, coins, and stocks. There are many different ways to make an precious metals portfolio. Three portfolios that people use for gold are the gold safety portfolio, gold profit portfolio, and finally gold balanced portfolio. All portfolios have various risks, but some risks are riskier than others. The gold safety portfolio is the method in which seventy percent of money is in physical bullion, which includes gold bars or coins. Out of gold production and gold exploration stocks, the gold production is the less risky. Gold is a form of stock and there are risks involved. The investor only needs to put ten percent in gold production. Finally the investor needs to put twenty percent in the Canadian dollar``. The reason why many investers are turing to a foregin currencey, is because of the falling United States dollar value. Witch makes the Euro, Japanese yen, British pound, Swedish krona and Swiss franc prime investment currencys. Next is the gold profit portfolio. This is the high risk, high reward portfolio. To achieve this portfolio only fifteen percent need to be in physical gold. The reason why physical gold is in such a low percentage is because physical gold is the safest form of investing. Next, the investor need's to put a majority of the portfolio in gold stocks, seventy percent to be exact. This is the high risk high reward investment. With this amount of percentage the investor can invest in gold exploration stocks. In which the company uses this money given threw stock, for gold exploration on their properties. Finally, the investor need's to put fifteen percent in the Canadian dollar, Euro, Japanese yen, British pound, Swedish krona and Swiss franc. The third and final portfolio is the gold balanced portfolio. This is the highly diversified and well rounded portfolio. Studies show that maintaining a balanced portfolio will produce the lowest risk reduction. Twenty-five perfect should be in physical gold. Next, forty-five percent should be in gold stocks. Finally, thirty percent should be invested in the Canadian dollar, Euro, Japanese yen, British pound, Swedish krona and Swiss franc. This type of portfolio will diversify investments and make it most beneficiary to the investor (Burgess, n.d.).

In a personal over the phone interview with Allen Snell, he said that his background for bullion is one year as managing NWT mint bullion department. When asked what percentage of a invester’s portfolio should be in bullion, he stated anywhere from ten to fifteen percent. Also he stated that it is never a bad time to start investing in bullion slowly and building up to greater amounts. Mr. Snell said that the best months to invest in bullion are January and December. Bullion prices are the lowest in the winter months. The best time to sell bullion is the summer months: August and September. Last year alone NWT mint sold over three hundred million dollars worth of bullion. NWT mint is one of the main suppliers in bullion. Mr. Snell figures that all the bullion sold throughout would be ten times three hundred million (January 2009).

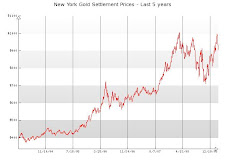

The investing markets are yielding to the fact that the global economy will remain weak in most of 2009. Under normal conditions safe haven investments would include land and real estate. With the falling housing, markets investors are staying away from all real estate. Precious metals are not considered a liability right now and are considered the best safe haven. Experts say because of the state of our economy, that it will drive precious metals prices up. In March of 2008, gold prices hit a record high of $1,033 dollars an ounce. This was followed by a normal eighteen percent correction, which pushed gold prices back down to $850 dollars an ounce. Gold prices rebounded and closed in on $1,000 dollars an ounce in mid-July. At the same time, the effects of the slowing housing market and credit markets were beginning to effect all investing. As a result, main gold positions were sold to cover losses from investments in other markets. Due to forced selling, this pushed the prices down over the next several months. During the later part of 2008, the United States dollar enjoyed a twenty percent increase as the price of gold was held down. Despite the lowering value of the dollar, it is still one of the world’s most important reserve currency. Foreign governments, institutions, and banks began to buy the United States dollar. This made the gold price to go to a year low of $683 dollars an ounce in October. Even though, gold had three twenty percent corrections and serious deflation in the market, gold came out with a positive 5.4% gain for the year. With this gain it out performed major index and commodity in the world. Some examples are Dow Jones at -34%, NASDAQ -41 %, S&P 500 -39%, and Oil -55%. The outlook for 2009 is expected to be an increase in prices. Due to Global economic turmoil and deflation in our dollar, it will continue to influence gold prices in the near term. Experts expect gold prices to break new records during 2009. It is expected to reach as high as $1,300 dollars or higher. The high would be a dramatic increase in price and profitability from years past. Precious metals are also expected to have as many as three or four selling points in 2009 (Burgess, 2009).

Many investors are turning away from the real estate market and turning to the precious metals market. Our recession makes bullion a good market to invest in and make a large profit in just a few years. The declining United States economy not only affects the bullion market, it also affects anything that uses precious metals. Jewelry, electronics, automotive and so many more areas are being affected.

Investing in precious metals is a good way to become financially well. It has many different advantages. With the current situation of our economy, many investors are turning to any form of precious metals they can get. Some forms to invest in vary from physical possession of these metals to stocks, jewelry, and so on. The possibility of benefiting from this market is endless.

Bullion is the most common form of precious metals that people invest in. It varies from grams to even pounds in weight. The types of bullion offered are gold, silver, platinum, and finally palladium. Investors in bullion all have different goals and monetary investments to put into this growing market. Silver is one of the cheapest metals to invest in. Silver is also an excellent conductor used in electronic circuitry. However, with this lower cost it is also in high demand. Due to industrial demand, there is an ongoing decrease of above ground stocks. In the 1990's silver inventories decreased by 1.2 billion ounces. The United States government is now, for the first time ever, a buyer of silver. The United States had four billion ounces of silver in a reserve after World War II. As of November 2000, reserves were depleted because the last few ounces were delivered to the United States mint for production of silver eagle coins. Silver supplies are and are only produced as a by product. Most remaining mines produce mostly copper, gold, lead, and zinc. Gold is one of the most expensive metals that play a role in thousands of dollars worth of investing. Most large investors invest in gold. With gold investors risk more but the profit is greater. Gold is a very durable metal; it will not tarnish like silver. Some of the finer products made out of gold are rings, necklaces, earrings, bracelets, etc. Platinum is more expensive than gold and is truly known as high-octane gold. Platinum is known to be a multi purpose metal because of its unique physical properties. Many industries depend on platinum. Most of the jewelry today is made of platinum. Japan has long been a traditional source of platinum jewelry. Platinum is prized for its beauty and strength making it the most secure precious metal for setting stones. One of the newest metals is Palladium. Not many new investors know about this metal. Palladium is known as the metal for the twenty-first century. Like platinum, palladium serves as a pollution reduction in today’s automobiles. Palladium is a very good conductor like silver. Unlike silver, palladium does not tarnish. Palladium is one of the rarest metals in the world even when compared to gold and silver. In 2003 the world's mines produced 6.5 million ounces of palladium; the production of gold was 84.1 million and silver was at an amazing 595.6 million ounces (Northwest Territoral mint, n.d.)

There are many different ways to invest in precious metals for investors today. Some ways to invest are bullion, coins, and stocks. There are many different ways to make an precious metals portfolio. Three portfolios that people use for gold are the gold safety portfolio, gold profit portfolio, and finally gold balanced portfolio. All portfolios have various risks, but some risks are riskier than others. The gold safety portfolio is the method in which seventy percent of money is in physical bullion, which includes gold bars or coins. Out of gold production and gold exploration stocks, the gold production is the less risky. Gold is a form of stock and there are risks involved. The investor only needs to put ten percent in gold production. Finally the investor needs to put twenty percent in the Canadian dollar``. The reason why many investers are turing to a foregin currencey, is because of the falling United States dollar value. Witch makes the Euro, Japanese yen, British pound, Swedish krona and Swiss franc prime investment currencys. Next is the gold profit portfolio. This is the high risk, high reward portfolio. To achieve this portfolio only fifteen percent need to be in physical gold. The reason why physical gold is in such a low percentage is because physical gold is the safest form of investing. Next, the investor need's to put a majority of the portfolio in gold stocks, seventy percent to be exact. This is the high risk high reward investment. With this amount of percentage the investor can invest in gold exploration stocks. In which the company uses this money given threw stock, for gold exploration on their properties. Finally, the investor need's to put fifteen percent in the Canadian dollar, Euro, Japanese yen, British pound, Swedish krona and Swiss franc. The third and final portfolio is the gold balanced portfolio. This is the highly diversified and well rounded portfolio. Studies show that maintaining a balanced portfolio will produce the lowest risk reduction. Twenty-five perfect should be in physical gold. Next, forty-five percent should be in gold stocks. Finally, thirty percent should be invested in the Canadian dollar, Euro, Japanese yen, British pound, Swedish krona and Swiss franc. This type of portfolio will diversify investments and make it most beneficiary to the investor (Burgess, n.d.).

In a personal over the phone interview with Allen Snell, he said that his background for bullion is one year as managing NWT mint bullion department. When asked what percentage of a invester’s portfolio should be in bullion, he stated anywhere from ten to fifteen percent. Also he stated that it is never a bad time to start investing in bullion slowly and building up to greater amounts. Mr. Snell said that the best months to invest in bullion are January and December. Bullion prices are the lowest in the winter months. The best time to sell bullion is the summer months: August and September. Last year alone NWT mint sold over three hundred million dollars worth of bullion. NWT mint is one of the main suppliers in bullion. Mr. Snell figures that all the bullion sold throughout would be ten times three hundred million (January 2009).

The investing markets are yielding to the fact that the global economy will remain weak in most of 2009. Under normal conditions safe haven investments would include land and real estate. With the falling housing, markets investors are staying away from all real estate. Precious metals are not considered a liability right now and are considered the best safe haven. Experts say because of the state of our economy, that it will drive precious metals prices up. In March of 2008, gold prices hit a record high of $1,033 dollars an ounce. This was followed by a normal eighteen percent correction, which pushed gold prices back down to $850 dollars an ounce. Gold prices rebounded and closed in on $1,000 dollars an ounce in mid-July. At the same time, the effects of the slowing housing market and credit markets were beginning to effect all investing. As a result, main gold positions were sold to cover losses from investments in other markets. Due to forced selling, this pushed the prices down over the next several months. During the later part of 2008, the United States dollar enjoyed a twenty percent increase as the price of gold was held down. Despite the lowering value of the dollar, it is still one of the world’s most important reserve currency. Foreign governments, institutions, and banks began to buy the United States dollar. This made the gold price to go to a year low of $683 dollars an ounce in October. Even though, gold had three twenty percent corrections and serious deflation in the market, gold came out with a positive 5.4% gain for the year. With this gain it out performed major index and commodity in the world. Some examples are Dow Jones at -34%, NASDAQ -41 %, S&P 500 -39%, and Oil -55%. The outlook for 2009 is expected to be an increase in prices. Due to Global economic turmoil and deflation in our dollar, it will continue to influence gold prices in the near term. Experts expect gold prices to break new records during 2009. It is expected to reach as high as $1,300 dollars or higher. The high would be a dramatic increase in price and profitability from years past. Precious metals are also expected to have as many as three or four selling points in 2009 (Burgess, 2009).

Many investors are turning away from the real estate market and turning to the precious metals market. Our recession makes bullion a good market to invest in and make a large profit in just a few years. The declining United States economy not only affects the bullion market, it also affects anything that uses precious metals. Jewelry, electronics, automotive and so many more areas are being affected.

References

Burgess, L. (n.d.) Investing in Gold. Retrieved February 18, 2009, from

http://goldworld.com

Burgess, L. (2009, January 5). Gold's 2009 outlook. Retrieved February 18, 2009, from http://goldworld.com

Northwest Territorial Mint - Custom Minting, Bullion Sales, Online Store. (n.d.). Retrieved February 18, 2009, from

http://nwtmint.com

Burgess, L. (n.d.) Investing in Gold. Retrieved February 18, 2009, from

http://goldworld.com

Burgess, L. (2009, January 5). Gold's 2009 outlook. Retrieved February 18, 2009, from http://goldworld.com

Northwest Territorial Mint - Custom Minting, Bullion Sales, Online Store. (n.d.). Retrieved February 18, 2009, from

http://nwtmint.com

Heya,

ReplyDeletefound your blog through Plinky.

Just want to clarify a few points because your thesis that "The outlook for precious metals in 2009 is projected to be very high. New profit records should be set in the year of 2009 for all metals." is very wrong.

Gold is a special case as it is widely seen as a currency in times of looming inflation and fragile economy. But investing in gold now gives you only a limited upside chance as it is trading near all-time highs and too much money is already 'parked' in gold.

Silver, Platinum and Palladium prices have collapsed. The gap between silver and gold is down from a historic average of 1:15 to 1:75 and the reason for this is the economic crisis. There is upside to current prices as 4/5th of all silver is mined as a by-product of industrial metal mining and with collapsing demand in Copper, Iron Ore etc. the output of silver goes down as well. There is likely to be a shortage in Silver sooner than in any of the other precious metals. But not in 2009, and certainly no 'new records'. This recession will last a while.

Platinum and especially Palladium prices are tied to industrial demand. Take Palladium where 60-70% of the world production is used in the auto industry, and you know how awful it looks there at the moment. Most if not all Palladium mines have higher production costs than what they get at the market now, means they have to sell at a loss.

If you want to invest in precious metals then you need a time horizon of minimum 2-3 years. I would prefer silver over the others as it has the most upside. And if you want to invest in any of the mines you have to do thorough research into their financials as most miners are struggling to survive, especially if prices stay low for another 6-12 months. Many mining companies have huge debt and liquidity problems now. Buying silver from NWT Mint or others is pointless if you do not want to buy 1000+ ounces, hidden costs are too high (they want to make profit) and it is neither safe nor reasonable. There are ETFs where you can benefit directly from a rising spot price.

One last advice - if you research for a paper it is always better to use independent sources instead of industry own references. Do not believe ANYTHING an industry (or company) publishes about their own business unless you can verify it independently. All the now failed banks claimed their business is fine, every public company wants their share price to go up and to lure new or reassure current investors.

Cheers

Hello,

ReplyDeleteI thought your paper was well thought out. It's good that you are into investing at such a young age and or tuned into what's happening in the world.

Also, just a quick question. How did you do your links to twitter updates. It's cool. I'd rather ask cause I feel to old trying to figure it out on my own. Something new will come out when I do finally figure it out.

Thanks,

DeAnna

ms deanna if i remember correctly like i went to was like were you can put wat you doin and copy and pasted my url of my blog for it in wat i was think! hope this helped...

ReplyDeletesorry couldn't be more of help

jeremy h